What is Ratio Analysis?

Ratio analysis is the numerical method to review the company’s financial soundness through financial ratios. In other words, financial ratio analysis examines important ratios that reveal the company’s assets and liabilities.

Stakeholders use financial ratios and evaluations to make crucial judgments about their commitments to a business. Now after understanding the ratio analysis meaning, let’s check out more about the types of ratio analysis, formulas, and uses.

Uses of Financial Ratio Analysis

Comparisons

Ratio analysis is used, among other things, to assess a company’s position in the marketplace by comparing its financial results to that of other companies in the same sector.

It helps businesses assess their unique strengths, weaknesses, and drawbacks by obtaining financial ratios from well-known rivals and comparing them to the Business’s ratios to detect market gaps. The leadership can then make choices intended to strengthen the company’s performance in the market using that information.

Determination of Market Trends

Ratio Analysis allows the organization to check for trends in their business performance. Established businesses gather information from financial reports across many time frames.

In addition to identifying any unanticipated financial disturbance for a particular reporting period, the trend observed can also be utilized to forecast the trajectory of future profitability.

Effectiveness of management

Financial ratio analysis is another tool that a company’s management can use to gauge how well assets and liabilities are managed.

Ineffective use of resources like cars, equipment, and buildings leads to high costs that need to be cut. Financial ratios help to assess whether funds are being used too much or too little.

Types of Ratio Analysis

Liquidity Ratio

Using the company’s current assets, its ability to pay down its debt is ascertained by its liquidity ratios. When a business has trouble making ends meet and cannot pay debts, it can turn its assets into cash and use the proceeds to pay off any outstanding debts.

There are two types of Liquidity Ratios:

- Current Ratio: The Ratio of a company’s current assets to current liabilities is known as the current Ratio. It determines a company’s capacity to meet its debt commitments over the next 12 months based on its liquidity. A higher current ratio will show that the company can easily pay off its short-term debt commitments. Its formula is:

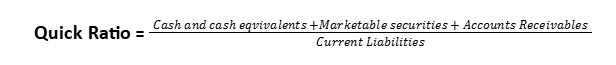

Quick Ratio: The quick Ratio, widely known as the acid test ratio, evaluates the company’s capacity to pay off short-term obligations using its most liquid resources. The formula of Quick Ratio is:

Profitability Ratios

Profitability ratios evaluate the company’s capacity to turn a profit about the costs that go along with it. A higher profitability ratio than in the last financial reporting period indicates that the company’s financial situation is improving.

There are four types of Profitability Ratios:

- Gross Profit Ratio :Gross profit ratio is used to ascertain the company’s operating profits.

- Net Profit Ratio: After subtracting both cash and non-cash expenses, net profit ratios are computed to assess the Business’s total profitability.

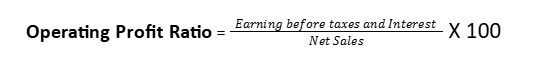

- Operating Profit Ratio: A company’s stability and capacity to pay off all of its long- and short-term debts are assessed using the operating profit ratio.

- Return of Capital Employed (ROCE): Return on investment Employed is used to evaluate a business’s profitability about the capital invested in the Business.

3. Solvency Ratios

Solvency ratios evaluate a business’s potential for long-term financial success. These ratios compare a firm’s debt levels with its assets, equity, or yearly income.

There are two types of Solvency Ratios:

Debt to Equity Ratio: The Ratio between total debt and investor’s equity is known as the debt-equity Ratio. It allows us to determine a company’s leverage. A company should have a debt-to-equity ratio of 2:1.

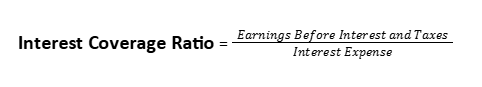

Interest Coverage Ratio: The interest coverage ratio is used to assess a company’s future solvency and evaluate how often its revenues would have to increase to pay its interest-related costs.

4. Turnover ratios

Turnover ratios evaluate how effectively a company uses its assets and liabilities to create sales and generate profit. It computes the turnover of liabilities, the use of inventories, the use of equipment, and the use of stock. These ratios are crucial because rising Turnover ratios increase a company’s ability to boost profits and revenues.

There are three Types of Turnover:

Fixed Assets Turnover Ratio: The effectiveness of a company in using its fixed assets to produce profits is assessed using the fixed assets turnover ratio.

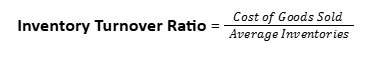

Inventory Turnover Ratio: The inventory turnover ratio is used to gauge how quickly a business turns its stocks into sales.

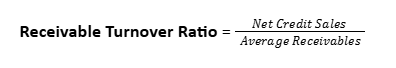

Receivable turnover ratio: The effectiveness of a company in realizing its account receivables is assessed using the receivable turnover ratio.

5. Earnings Ratios

The earnings ratio is a tool used to assess a company’s profits for its shareholders.

There are two types of Earning Ratios:

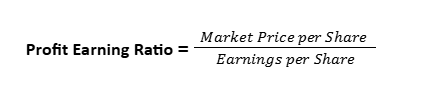

Profit Earning Ratios: Profit Earning ratio is a tool that is used to know the profit earning capacity of the company.

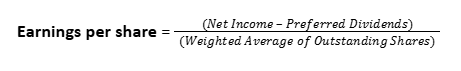

Earnings per Share: EPS ratio is used to evaluate the earnings of an equity shareholder based on each share.

Conclusion

The foundation for financial analysis is laid by ratio analysis. The analysts of financial statements also perform ratio analysis to have a better picture of a company’s finances.

Financial statements provide data that, unless correctly analyzed, is of limited benefit. To swiftly analyze financial data and derive useful insights, consider using key financial ratios in qualitative analysis.

It can assist you in discovering information that influences stock prices that, occasionally, even the corporation is unaware of. Moreover, you can also compare your ratios to other companies’ ratios to make improvements and survive in the competitive market.

Reference

- https://zerodha.com/varsity/chapter/financial-ratio-analysis/

- https://gocardless.com/guides/posts/top-7-financial-ratios/

- https://www.wallstreetmojo.com/financial-ratios/

- https://study.com/academy/lesson/financial-statement-ratios-determining-company-performance.html

- https://www.deskera.com/blog/financial-ratios/

Leave a Reply